Bank statements play a crucial role in managing personal and business finances. They provide a detailed record of transactions, account balances, and other financial activities. Understanding the various types of bank statements is essential for individuals and businesses to maintain financial transparency and make informed decisions. In this article, we will explore the common types of bank statements and their significance.

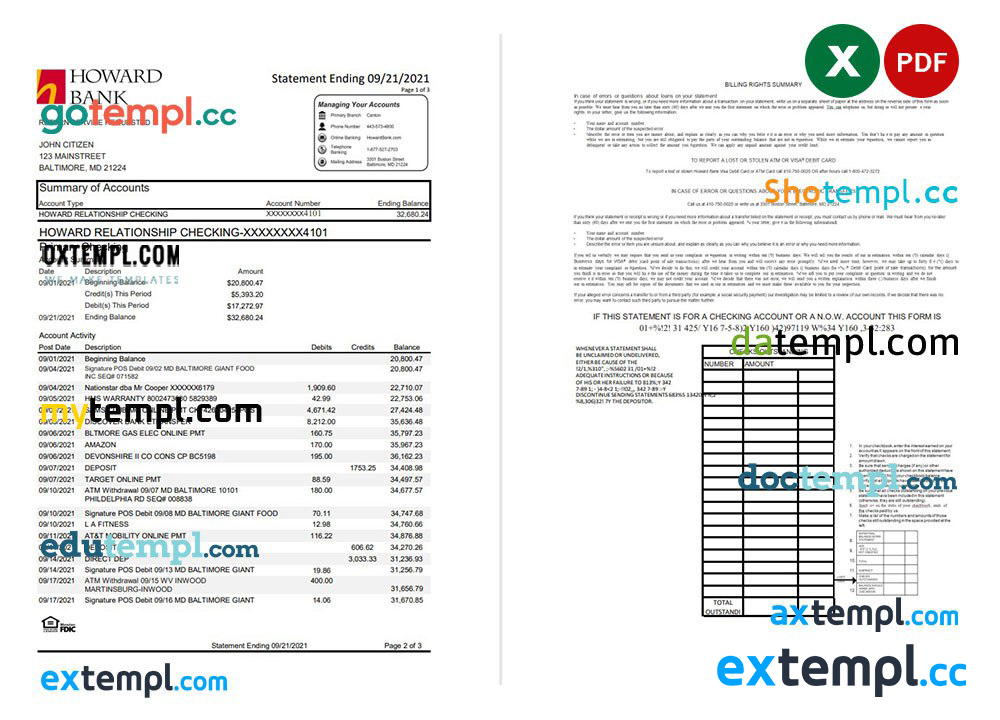

1.Personal Bank Statements:

Personal bank statements are the most common type, typically issued to individuals who hold checking or savings accounts. These statements provide a comprehensive overview of transactions, including deposits, withdrawals, checks written, and electronic transfers. Individuals use personal bank statements to track their spending, monitor account balances, and reconcile their finances.

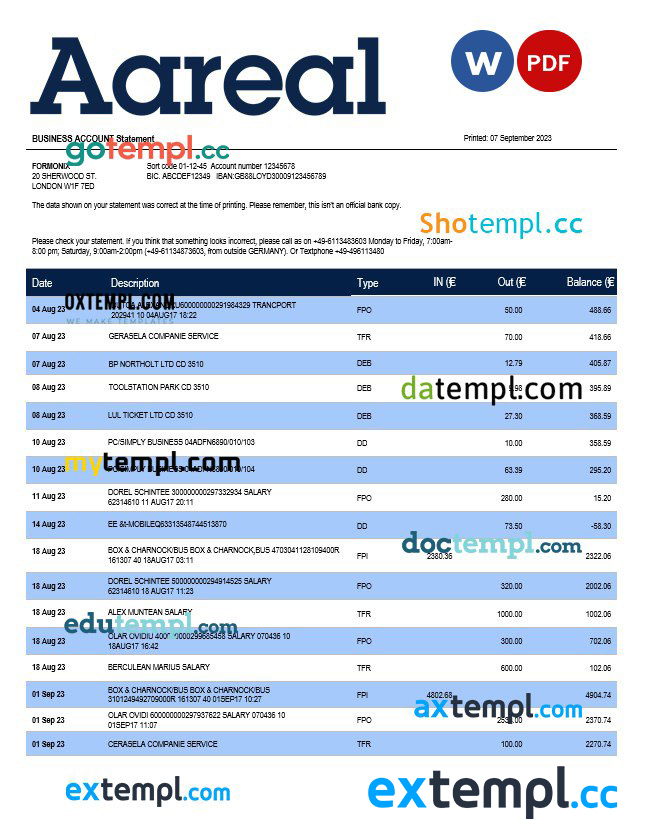

2.Business Bank Statements:

Businesses, whether small or large, receive business bank statements that are tailored to their specific needs. These statements include details about business-related transactions, such as payments received, expenses incurred, and any overdraft fees. Business bank statements are crucial for financial management, tax reporting, and assessing the overall health of the company’s finances.

3.Online Statements:

With the advent of online banking, many financial institutions provide electronic or online statements. These statements are accessible through the bank’s secure website or mobile app. Online statements offer the same information as paper statements, including transaction history, account balances, and other relevant details. They are convenient, environmentally friendly, and can be easily archived for future reference.

4.Credit Card Statements:

Credit card statements are a specialized type of bank statement that focuses on credit card transactions. These statements detail purchases, cash advances, interest charges, and payments made during a specific billing cycle. Credit card statements are essential for tracking credit card usage, managing credit limits, and identifying any unauthorized transactions.

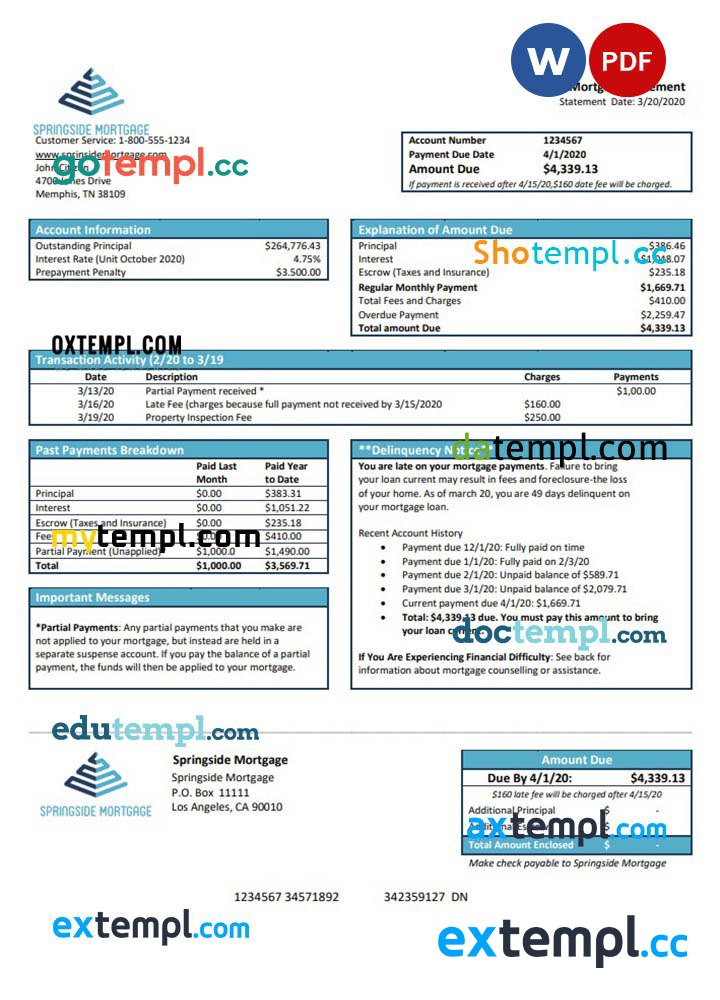

5.Mortgage Statements:

Individuals with mortgages receive mortgage statements from their lending institutions. These statements outline details of the mortgage, including the outstanding balance, interest rate, and payment history. Mortgage statements are crucial for homeowners to keep track of their loan status, plan for future payments, and understand the impact of interest on their mortgage.

6.Investment Account Statements:

Investors receive statements from brokerage firms detailing the performance of their investment accounts. These statements include information about stock transactions, dividends, interest, and any fees associated with the investment account. Investors use these statements to assess the growth of their portfolios and make informed decisions about their investments.

Understanding the various types of bank statements is essential for effective financial management. Whether you are an individual looking to track personal expenses or a business monitoring its financial health, bank statements provide valuable insights. With the advent of technology, online statements have become increasingly popular, offering a convenient and secure way to access financial information. By regularly reviewing bank statements, individuals and businesses can make informed financial decisions, identify discrepancies, and maintain a healthy financial outlook.